Survivor Guide: Staying Pocket Friendly!💸

Staying pocket-friendly is all about making smart choices. You need not resist yourself from going out with your friends in those fancy cafes and restaurants, watching a movie, going on dates, spending on app subscriptions, buying your favourite pair of sneakers, gifting yourself a new luxury bag, or restocking your skincare and makeup products.

Do you want to know how to do all the things listed above and still save money?

Table Of Contents:

Why To Stay Pocket Friendly?

Staying pocket-friendly as a student is important for several reasons:

- Financial Independence: It helps students learn to manage their finances independently, preparing them for financial responsibilities in the future.

- Debt Avoidance: By spending wisely and saving money, students can avoid or minimize debt from loans or credit cards.

- Stress Reduction: Financial concerns can be a significant source of stress. Being pocket-friendly can alleviate financial worries and contribute to better mental health.

- Resourcefulness: It encourages students to be resourceful and creative with their spending, finding cost-effective solutions for their needs.

- Future Savings: Money saved during student life can be invested in future endeavors, such as further education, travel, or starting a business.

- Emergency Preparedness: Having savings can provide a safety net for unexpected expenses or emergencies.

Overall, being pocket-friendly allows students to enjoy their present lives while also planning for a secure financial future.

When To Start?

It’s generally recommended for students to start saving money as early as possible. Research suggests that money habits can be formed by the age of seven. Starting early can help establish lifelong financial habits and take advantage of compound interest over time.

Here are some tips for young savers:

- Create a Saving System: Use methods like the four-jar system to allocate money for saving, spending, giving, and growing.

- Set Goals and Habits: Determine what you’re saving for and establish regular saving habits.

- Spend Less: Learn to manage expenses and resist the urge to spend on non-essentials.

- Invest Wisely: Consider small investment plans like mutual funds or high-yield savings accounts, which can be started with minimal amounts.

How To Stay Pocket Friendly?

1. Budgeting: Your Financial Blueprint

Creating a budget is the first step to staying pocket-friendly. Track your income and expenses to understand where your money goes. Use budgeting apps or simple spreadsheets to set spending limits and stick to them. For reference, you can use apps like YNAB ( You Need A Budget ), PocketGuard, TrackWallet: Expense Tracker, etc.

2. Smart Shopping: Buy Wisely

- Before making a purchase, ask yourself if it’s a need or a want. Don't just get influenced by new trends that change everyday. Instead spend on things which is useful to you in person.

- Try making a rule to buy only one branded item every month. This way you will not over spend on luxurious items.

- Always wait for festival sales and offers, use coupons, and consider buying second-hand items when appropriate.

- Always compare prices on different websites such as Amazon, Flipkart, Meesho etc. and check for online deals before buying.

- While buying new clothes, try spending on basics which can be styled and re-styled easily.

- For non-perishable items, buying in bulk can be cheaper in the long run.

3. Food For Thought: Economize Your Eating

Feel like you're (literally) eating up your Student Loan? Minimizing food expenses as a student living out can be challenging, but with a few strategic approaches, you can make your budget stretch further:

- Plan your meals: Create a weekly meal plan to avoid impulse buys to satisfy hunger pangs.

- Cook at Home: Preparing your meals at home is usually cheaper than eating out.

- Use Student Discounts: Take advantage of student discounts available at local grocery stores or markets.

- Avoid Waste: Store food properly to extend its shelf life and organize your fridge to keep track of what you have.

- Carry your meals: While going to college

- Part-Time Job: You can also consider a part-time job in food services where meals may be provided during shifts,

4. Transportation: Travel Economically

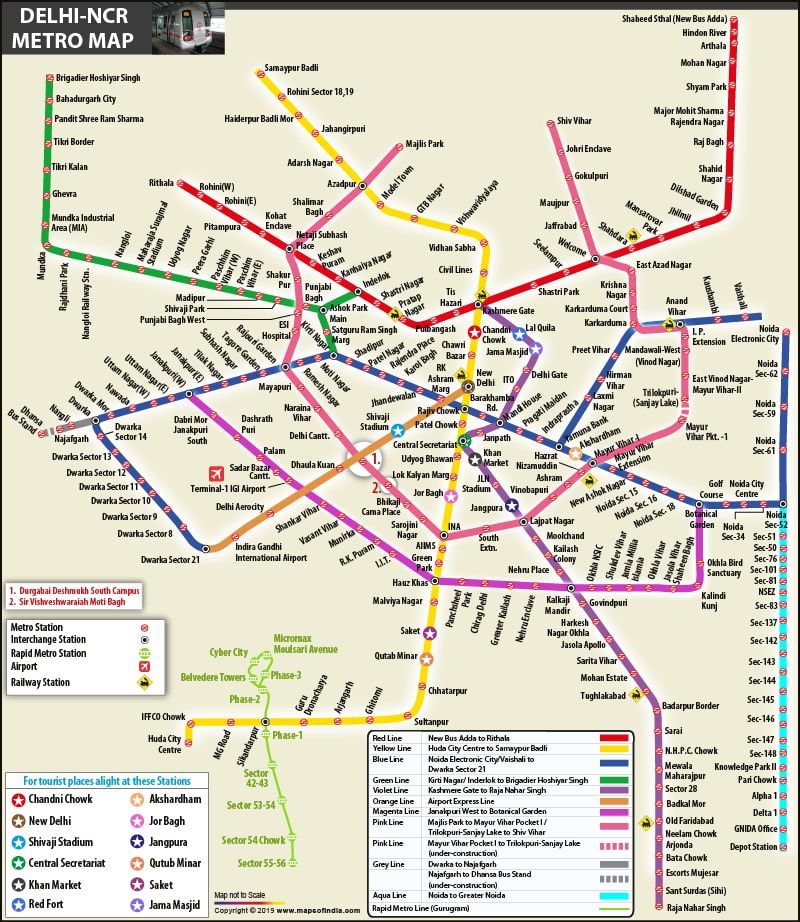

Use public transportation, carpool, or bike instead of driving alone. Not only is it eco-friendly, but it also saves you money on gas, parking, and maintenance. In cities like Delhi, Gurgaon, and Noida there is a very convenient service of Metros which are economically feasible and easy to use.

5. Entertainment: Low-Cost Leisure

Look for free or low-cost entertainment options in your community. Visit parks, museums on discount days, or host game nights at home. Use library memberships to borrow books, movies, and music.

Some of the popular museums in Delhi are:

- Air Force Museum.

- Craft Museum.

- Dr Ambedkar National Memorial.

- Election museum.

- Gandhi Museum.

- Gandhi Smriti Museum.

- Ghalib Museum and Library.

- Indira Gandhi Memorial.

6. Utilities: Slash Those Bills

Be mindful of your utility usage. Turn off lights when not in use, unplug electronics, and use energy-efficient appliances. You can consider a programmable thermostat to save on heating and cooling.

7. Subscriptions and Memberships: Assess and Cancel

Students can reduce expenses on online subscriptions and memberships by adopting several strategies:

- Audit Your Subscriptions: Regularly review your subscriptions and memberships. Cancel any that you no longer use or find valuable.

- Share Costs: Split the cost of subscriptions with friends or family members where possible.

- Student Discounts: Many services offer discounts for students. Always check if a student discount is available before subscribing.

- Free Alternatives: Look for free versions or alternatives to paid subscriptions. For example, use open-source software instead of paid versions.

- Library Resources: Utilize digital resources and e-books available through library memberships at no extra cost.

- Negotiate Rates: Contact service providers to inquire about any ongoing promotions or discounts that could lower your costs. Many a time we are not aware about the ongoing discounts and offers.

- Bundled Services: Some platforms offer bundles that include multiple services at a reduced rate compared to subscribing to each service individually.

8. DIY: The Joy of Self-Sufficiency

Learn to do things yourself instead of paying for services. From home repairs to personal grooming, there are tutorials online for almost everything. Additionally, doing things independently can lead to a sense of accomplishment, self-reliance, and the ability to enjoy your own company, which is crucial for mental well-being. It also helps you avoid distractions and the influence of others, allowing for personal growth.

9. Savings and Investments: Your Future Fund

Make saving a habit. Even a small amount set aside regularly can grow over time. Look into investment options that suit your risk profile to grow your wealth.

Students looking to start investing have several platforms they can consider. Here are a few that are known for being user-friendly and suitable for beginners:

- Robinhood: Known for commission-free trading and its user-friendly interface, Robinhood allows investing in stocks, ETFs, and options with as little as $.

- Public.com: Offers a unique social media experience where users can share insights and learn from other investors.

- Webull: A platform that caters to both beginner and intermediate investors, offering commission-free trading.

These platforms are designed to be easy to understand and powerful enough to handle long-term investing needs. They also offer educational resources to help students learn about investing as they go. It’s important to research and choose a platform that aligns with your investment goals and educational needs.

10. Mindful Mindset: The Art of Contentment

Cultivate contentment with what you have. Resist the urge to keep up with trends and focus on long-term happiness over short-term gratification.

11. Pocket Friendly Places

Cutting your expenses does not mean you do not explore new places. It is just you go to places that are cost effective. You can visit the following places in Delhi:

- Hauz Khas Village

- India Gate

- Red Fort

- Gurudwara Bangla Sahib

- Connaught Place

- Chandini Chowk

- Lodhi Garden

- Lotus Temple

- Qutub Minar

- Agrasen Ki Baoli

12. Pocket Friendly Cafes

If you want to go out with friends in Delhi, keep in your mind these cafes and restaurants:

- Cafe Junk

- Scorpio Cafe

- Chai Garam

- Ricos

- Big Yellow Door

- Cafe Bella Italia

- T'Pot Cafe

- Garden Lovers Botanical Boutique & Cafe

Conclusion

In conclusion, embracing a savings mindset and maintaining a pocket-friendly lifestyle as a student isn’t just about securing your financial future—it’s about cultivating discipline, foresight, and self-reliance. By starting early, students can harness the power of compound interest, build a safety net for unexpected expenses, and enjoy the peace of mind that comes with financial security.

Moreover, learning to balance saving with sensible spending can lead to a more fulfilling and less stressful student life. Remember, every penny saved today is a step towards a more prosperous tomorrow. So, start small, stay consistent, and watch your savings grow. Your future self will thank you.

For more such interesting and exciting updates about your college and upcoming fests, stay tuned to Apna Adda!